Revenue to rise 23%; asset-light expansion to support credit profiles of organised cos

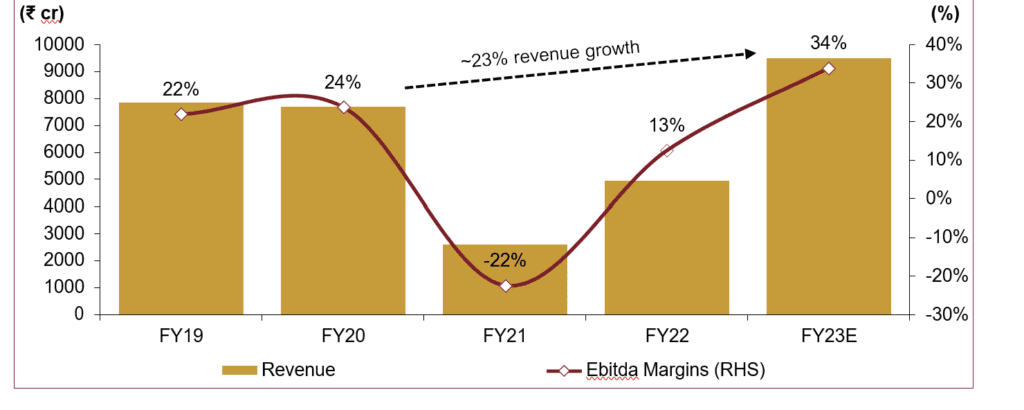

Higher average room rate (ARR) and occupancy will help the Indian hotel industry log a strong improvement in profitability, as represented by earnings before interest, tax, depreciation and amortisation (Ebitda) margin, to around 34% this fiscal, compared with 24% pre-pandemic (fiscal 2020).

Revenue, on its part, will increase ~23% over the pre-pandemic level, riding on a strong recovery in business travel and continued traction in leisure travel.

The strong business performance, coupled with limited capital spend, will improve the credit profiles of players. A CRISIL Ratings analysis of hotels with an aggregate of ~40,000 rooms1 across categories indicates as much.

Says Mohit Makhija, Senior Director, CRISIL Ratings, “Leisure travel had gained traction post the Delta wave last fiscal, while business travel has started picking up steadily after a much milder Omicron wave in Jan 2022. This has been fuelling demand in the MICE (meetings, incentives, conventions and events) segment. CRISIL Ratings believes that improvement in international business travel in the second half of this fiscal will strengthen the industry performance. Occupancy will rise to ~73% this fiscal (68% in fiscal 2020), while average room rate (ARR) should increase 8-10%.”

The gap between demand and supply will aid the improvement in ARR. Developers had held back on capex amid the pandemic-induced uncertainties. While the sharp rebound in demand may spur an increase in capex, supply will take a while to catch up because of the long gestation period for setting up a greenfield hotel. That will favour existing hotels.

Meanwhile, organised players are increasing their footprint in an asset-light way. They are increasing capacity by entering into hotel management contracts for existing standalone properties, which will limit their upfront capital costs and keep leverage in control. Several standalone hotels couldn’t sail through the challenges during the last two years. Some of them have been shut down permanently, while others are exploring opportunities to collaborate with organised players. The branded and organised players have been utilising the opportunity to expand their footprint in a market that is expected to grow well.

In the wake of the pandemic, hotels had recalibrated their costs by taking a hard look at their fixed costs and efficiencies, many of which have led to permanent savings in operating costs. The measures include reassessing employee headcount using automation and better peak-hour manpower planning. Additionally, steps such as eliminating high-cost, low-preference items from food and beverage menus and ensuring efficiency improvement to keep utility expenses in check have helped improve their cost structures.

Says Anand Kulkarni, Director, CRISIL Ratings, “Strong revenue growth and cost optimisation measures will boost profitability of organised players this fiscal. Furthermore, asset-light expansion augurs well for their balance sheets. While the credit profiles were stressed in the last two fiscals, this fiscal will bring a material improvement, with interest coverage estimated at ~4 times against ~2.6 times in fiscal 2020 and the debt to Ebitda ratio seen improving to ~1.7 times from ~3.4 times.”

That said, any economic slowdown and its impact on business travel, especially on a global scale, remains a monitorable.

1 Our analysis covers mid-sized to large hotel chains (having more than 3,500 rooms on average). The pace of recovery is expected to be slower for smaller firms and single properties because of limited financial flexibility and modest sponsor profiles.

Annexure

Chart 1: Trend in revenue and operating margin

For further information contact:

| Media relations | Analytical contacts | Customer service helpdesk |

| Aveek Datta Media Relations CRISIL Limited M: +91 99204 93912 B: +91 22 3342 3000 [email protected] Prakruti Jani Media Relations CRISIL Limited M: + 91 98678 68976 B: +91 22 3342 3000 [email protected] Rutuja Gaikwad Media Relations CRISIL Limited M: +91 98195 22010 B: +91 22 3342 3000 [email protected] | Mohit Makhija Senior Director CRISIL Ratings Limited B: +91 124 672 2000 [email protected] Anand Kulkarni Director CRISIL Ratings Limited B: +91 22 3342 3000 [email protected] | Timings: 10.00 am to 7.00 pm Toll free Number:1800 267 1301 For a copy of Rationales / Rating Reports: [email protected] For Analytical queries: [email protected] |

About CRISIL Ratings Limited (A subsidiary of CRISIL Limited)

CRISIL Ratings pioneered the concept of credit rating in India in 1987. With a tradition of independence, analytical rigour and innovation, we set the standards in the credit rating business. We rate the entire range of debt instruments, such as, bank loans, certificates of deposit, commercial paper, non-convertible / convertible / partially convertible bonds and debentures, perpetual bonds, bank hybrid capital instruments, asset-backed and mortgage-backed securities, partial guarantees and other structured debt instruments. We have rated over 33,000 large and mid-scale corporates and financial institutions. We have also instituted several innovations in India in the rating business, including rating municipal bonds, partially guaranteed instruments and infrastructure investment trusts (InvITs).

CRISIL Ratings Limited (“CRISIL Ratings”) is a wholly-owned subsidiary of CRISIL Limited (“CRISIL”). CRISIL Ratings Limited is registered in India as a credit rating agency with the Securities and Exchange Board of India (“SEBI”).

For more information, visit www.crisilratings.com